What is BlockChain?

Blockchain appears to be muddled, and it certainly can be, yet its central idea is actually very basic. A blockchain is a sort of information base. To have the option to comprehend blockchain serves to initially comprehend what a data set really is.

A data set is an assortment of data that is put away electronically on a PC framework. Data, or information, in data sets is regularly organized in table configuration to take into account simpler looking and sifting for explicit data. What is the contrast between somebody utilizing a bookkeeping page to store data instead of an information base?

Bookkeeping pages are intended for one individual, or a little gathering of individuals, to store and access restricted measures of data. Conversely, a data set is intended to house altogether bigger measures of data that can be gotten to, separated, and controlled rapidly and effectively by quite a few clients on the double.

Huge data sets accomplish this by lodging information on workers that are made of amazing PCs. These workers can once in a while be assembled utilizing hundreds or thousands of PCs to have the computational force and capacity limit important for some clients to get to the information base at the same time. While a bookkeeping page or data set might be available to quite a few groups, it is regularly claimed by a business and overseen by a delegated person that has full oversight over how it functions and the information inside it.

A blockchain is a developing rundown of records, called blocks, that are connected together utilizing cryptography. Each square contains a cryptographic hash of the past block, a timestamp, and exchange information. The timestamp demonstrates that the exchange information existed when the square was distributed to get into its hash. Squares contain the hash of the past block, shaping a chain, with each extra squares supporting the ones preceding it. Accordingly, blockchains are impervious to adjustment of their information because once recorded, the information in some random square can't be changed retroactively without modifying every single resulting block.

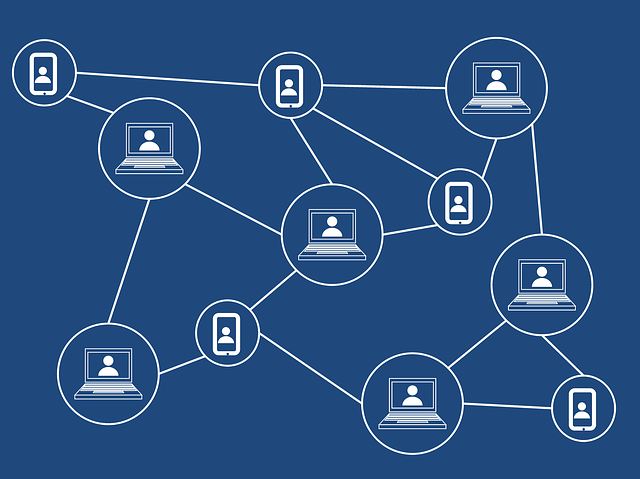

Blockchains are commonly overseen by a shared organization for use as an openly dispersed record, where hubs aggregately cling to a convention to impart and approve new squares. Even though blockchain records are not unalterable as forks are conceivable, blockchains might be considered secure by plan and represent a disseminated processing framework with high Byzantine shortcoming tolerance.

The blockchain was concocted by an individual utilizing the name Satoshi Nakamoto in 2008 to fill in as the public exchange record of the digital money bitcoin. The personality of Satoshi Nakamoto stays obscure to date. The innovation of the blockchain for bitcoin made it the primary computerized money to take care of the twofold spending issue without the need of a confided power or focal worker.

The bitcoin configuration has roused other applications and blockchains that are clear by general society and are broadly utilized by cryptographic forms of money. The blockchain is viewed as a kind of installment rail. Private blockchains have been proposed for business use yet Computerworld called the showcasing of such privatized blockchains without an appropriate security model "snake oil". However, others have contended that permission blockchains, if painstakingly planned, might be more decentralized and accordingly safer by and by than permissionless ones.

History of BlockChain

Cryptographer David Chaum first proposed a blockchain-like convention in quite a while 1982 thesis "PC Systems Established, Maintained, and Trusted by Mutually Suspicious Groups." Further work on a cryptographically gotten chain of squares was portrayed in 1991 by Stuart Haber and W. Scott Stornetta. They needed to carry out a framework where archive timestamps couldn't be messed with. In 1992, Haber, Stornetta, and Dave Bayer fused Merkle trees to the plan, which improved its productivity by permitting a few archive endorsements to be gathered into one block.

The first blockchain was conceptualized by an individual known as Satoshi Nakamoto in 2008. Nakamoto improved the plan in a significant manner utilizing a Hashcash-like strategy to timestamp blocks without expecting them to be endorsed by a confided-in party and acquainting a troubled boundary with a balance out rate with which squares are added to the chain. The plan was executed the next year by Nakamoto as a center segment of the digital currency bitcoin, where it fills in as the public record for all exchanges on the network.

In August 2014, the bitcoin blockchain document size, containing records of all exchanges that have happened on the organization, arrived at 20 GB. In January 2015, the size had developed to very nearly 30 GB, and from January 2016 to January 2017, the bitcoin blockchain developed from 50 GB to 100 GB in size. The record size had surpassed 200 GiB by mid-2020.

The words square and chain were utilized independently in Satoshi Nakamoto's unique paper, yet were in the end promoted as a solitary word, blockchain, by 2016. As indicated by Accenture, utilization of the dissemination of developments hypothesis recommends that blockchains achieved a 13.5% selection rate inside monetary administrations in 2016, hence arriving at the early adopter's phase. Industry exchange bunches joined to make the Global Blockchain Forum in 2016, a drive of the Chamber of Digital Commerce.

In May 2018, Gartner tracked down that just 1% of CIOs showed any sort of blockchain appropriation inside their associations, and just 8% of CIOs were for the time being "arranging or dynamic experimentation with blockchain". For the year 2019 Gartner revealed 5% of CIOs accepted blockchain innovation was a 'distinct advantage' for their business.

Capacity Structure

One key distinction between an ordinary data set and a blockchain is how the information is organized. A blockchain gathers data together in gatherings, otherwise called blocks, that hold sets of data. Squares have certain capacity limits and, when filled, are bound onto the recently filled square, shaping a chain of information known as the "blockchain." All new data that follows that newly added block is aggregated into a recently framed square that will at that point likewise be added to the chain once filled.

An information base designs its information into tables though a blockchain, similar to its name suggests, structures its information into lumps that are fastened together. This makes it with the goal that all blockchains are data sets however not all information bases are blockchains. This framework likewise inalienably makes an irreversible course of events of information when carried out in a decentralized nature. At the point when a square is filled it is unchangeable and turns into a piece of this timetable. Each square in the chain is given an accurate timestamp when it is added to the chain.

Decentralization

To comprehend blockchain, it is informative to see it with regards to how it has been executed by Bitcoin. Like a data set, Bitcoin needs an assortment of PCs to store its blockchain. For Bitcoin, this blockchain is only a particular kind of information base that stores each Bitcoin exchange at any point made. For Bitcoin's situation, and not at all like most information bases, these PCs are not all under one rooftop, and every PC or gathering of PCs is worked by a special individual or gathering of people.

Envision that an organization claims a worker included 10,000 PCs with a data set holding the entirety of its customer's record data. This organization has a distribution center containing these PCs under one rooftop and has full control of every one of these PCs and all the data contained inside them. Essentially, Bitcoin comprises thousands of PCs, yet every PC or gathering of PCs that hold its blockchain is in an alternate geographic area and they are totally worked by isolated people or gatherings of individuals. These PCs that cosmetics Bitcoin's organization are called hubs.

In this model, Bitcoin's blockchain is utilized in a decentralized way. In any case, private brought together blockchains, where the PCs that make up its organization are claimed and worked by a solitary element, do exist.

In a blockchain, every hub has a full record of the information that has been put away on the blockchain since its commencement. For Bitcoin, the information is the whole history of all Bitcoin exchanges. If one hub has a mistake in its information, it can utilize a large number of different hubs as a kind of perspective highlight right itself. Along these lines, nobody hubs inside the organization can modify the data held inside it. Along these lines, the historical backdrop of exchanges in each square that make up Bitcoin's blockchain is irreversible.

On the off chance that one client alters Bitcoin's record of exchanges, any remaining hubs would cross-reference one another and effectively pinpoint the hub with the mistaken data. This framework assists with building up a precise and straightforward request of occasions. For Bitcoin, this data is a rundown of exchanges, however, it likewise is workable for a blockchain to hold an assortment of data like legitimate agreements, state IDs, or an organization's item stock.

To change how that framework functions or the data put away inside it, a greater part of the decentralized organization's figuring force would have to concede to said changes. This guarantees that whatever changes do happen are to the greatest advantage of the dominant part.

By putting away information across its shared organization, the blockchain kills various dangers that accompany information being held centrally. The decentralized blockchain may utilize impromptu message passing and convey organizing. One danger of an absence of decentralization is a purported "51% assault" where a focal element can oversee the greater part of an organization and can control that particular blockchain record voluntarily, permitting twofold spending.

Distributed blockchain networks need to bring together places of weakness that PC saltines can misuse; moreover, it has no main issue of disappointment. Blockchain security techniques incorporate the utilization of public-key cryptography. A public key is a location on the blockchain. Worth tokens sent across the organization are recorded as having a place with that location. A private key resembles a secret phrase that gives its proprietor admittance to their computerized resources or the way to in any case associate with the different abilities that blockchains now support. Information put away on the blockchain is for the most part considered incorruptible.

Each hub in a decentralized framework has a duplicate of the blockchain. Information quality is kept up by huge data set replication and computational trust. No concentrated "official" duplicate exists and no client is "trusted" more than any other. Transactions are communicated to the organization utilizing programming. Messages are followed through on a best-exertion premise.

Mining hubs approve transactions, add them to the square they are building, and afterward broadcast the finished square to other nodes. Blockchains utilize different time-stepping plans, like evidence of work, to serialize changes. Alternative agreement strategies incorporate confirmation of stake. The growth of a decentralized blockchain is joined by the danger of centralization because the PC assets needed to handle bigger measures of information become more expensive.

Straightforwardness

Due to the decentralized idea of Bitcoin's blockchain, everything exchanges can be straightforwardly seen by either having an individual hub or by utilizing blockchain travelers that permit anybody to see exchanges happening live. Every hub has its own duplicate of the chain that gets refreshed as new squares are affirmed and added. This implies that on the off chance that you needed to, you could follow Bitcoin any place it goes.

For instance, trades have been hacked in the past where the individuals who held Bitcoin on the trade lost everything. While the programmer might be completely mysterious, the Bitcoins that they removed are effectively discernible. If the Bitcoins that were taken in a portion of these hacks were to be moved or spent someplace, it would be known.

Is Blockchain Secure?

Blockchain innovation represents the issues of safety and trust severally. In the first place, new squares are constantly put away straightly and sequentially. That is, they are constantly added to the "end" of the blockchain. If you investigate Bitcoin's blockchain, you'll see that each square has a situation on the chain, called a "tallness." As of November 2020, the square's statue had arrived at 656,197 squares up until this point.

After a square has been added to the furthest limit of the blockchain, it is hard to return and adjust the substance of the square except if the larger part arrived at an agreement to do as such. That is because each square contains its own hash, alongside the hash of the square before it, just as the recently referenced time stamp. Hash codes are made by a numerical capacity that transforms computerized data into a series of numbers and letters. If that data is altered in any capacity, the hash code changes too.

Here's the reason that is critical to security. Suppose a programmer needs to modify the blockchain and take Bitcoin from every other person. If they somehow happened to change their own single duplicate, it would at this point don't line up with every other person's duplicate. At the point when every other person cross-references their duplicates against one another, they would see this one duplicate stick out and that programmer's rendition of the chain would be given away a role as ill-conceived.

Prevailing with such a hack would necessitate that the programmer all the while control and adjust 51% of the duplicates of the blockchain so their new duplicate turns into the greater part duplicate and hence, the settled upon the chain. Such an assault would likewise require an enormous measure of cash and assets as they would have to re-try the entirety of the squares since they would now have diverse timestamps and hash codes.

Because of the size of Bitcoin's organization and how quick it is developing, the expense to pull off such an accomplishment would presumably be unrealistic. In addition to the fact that this would be amazingly costly, however, it would likewise likely be unbeneficial. Doing something like this would not go unseen, as organization individuals would see such extraordinary modifications to the blockchain. The organization individuals would then fork off to another variant of the chain that has not been influenced.

This would make the assaulted adaptation of Bitcoin fall in esteem, making the assault at last trivial as the agitator has control of a useless resource. The equivalent would happen if the troublemaker were to assault the new fork of Bitcoin. It is fabricated this way so that partaking in the organization is definitely more financially boosted than assaulting it.

How is Blockchain Used?

As we presently know, blocks on Bitcoin's blockchain store information about money-related exchanges. Yet, incidentally, blockchain is really a dependable method of putting away information about different kinds of exchanges, too.

A few organizations that have effectively fused blockchain incorporate Walmart, Pfizer, AIG, Siemens, Unilever, and a large group of others. For instance, IBM has made its Food Trust blockchain1 follow the excursion that food items take to get to its areas.

For what reason do this? The food business has seen innumerable flare-ups of e Coli, salmonella, listeria, just as unsafe materials being coincidentally acquainted with food sources. Before, it has required a long time to discover the wellspring of these episodes or the reason for ailment from what individuals are eating.

Utilizing blockchain enables brands to follow a food item's course from its starting point, through each stop it makes, lastly its conveyance. If food is discovered to be polluted, it very well may be followed right back through each stop to its starting point. That, however, these organizations can likewise now see all the other things it might have interacted with, permitting the ID of the issue to happen far sooner, possibly saving lives. This is one illustration of blockchains practically speaking, yet there are numerous different types of blockchain execution.

Banking and Finance

Maybe no industry stands to profit by coordinating blockchain into its business tasks more than banking. Monetary organizations just work during business hours, five days per week. That implies on the off chance that you attempt to store a beware of Friday at 6 p.m., you will probably need to stand by until Monday morning to see that cash hit your record. Regardless of whether you do put aside your installment during business hours, the exchange can in any case take one to three days to confirm because of the sheer volume of exchanges that banks need to settle. Blockchain, then again, never rests.

By coordinating blockchain into banks, shoppers can see their exchanges prepared in just 10 minutes,2 fundamentally the time it takes to add a square to the blockchain, paying little heed to occasions or the hour of day or week. With blockchain, banks likewise have the chance to trade assets between organizations all the more rapidly and safely. In the stock exchanging business, for instance, the repayment and clearing cycle can require as long as three days (or more, if exchanging universally), implying that the cash and offers are frozen for that timeframe.

Given the size of the totals in question, even the couple of days that the cash is on the way can convey massive expenses and dangers for banks. European bank Santander and its exploration accomplices put the possible investment funds at $15 billion to $20 billion a year.3 Capgemini, a French consultancy, appraises that customers could set aside $16 billion in banking and protection expenses each year4 through blockchain-based applications.

Money

Blockchain structures the bedrock for digital currencies like Bitcoin. The U.S. dollar is constrained by the Federal Reserve. Under this focal power framework, a client's information and cash are actually at the impulse of their bank or government. On the off chance that a client's bank is hacked, the customer's private data is in danger. On the off chance that the customer's bank breakdowns or they live in a country with a temperamental government, the worth of their money might be in danger. In 2008, a portion of the banks that ran out of cash were rescued halfway utilizing citizen cash. These are the concerns out of which Bitcoin was first considered and created.

By spreading its activities across an organization of PCs, blockchain permits Bitcoin and other cryptographic forms of money to work without the requirement for a focal position. This lessens hazards as well as disposes of a significant number of the handling and exchange charges. It can likewise give those in nations with temperamental monetary forms or monetary frameworks more steady cash with more applications and a more extensive organization of people and foundations they can work with, both locally and globally.

Utilizing digital money wallets for bank accounts or as a method for installment is particularly significant for individuals who have no state distinguishing proof. A few nations might be war-torn or have governments that come up short on any genuine framework to give recognizable proof. Residents of such nations might not approach investment funds or money market funds and in this way, no real way to securely store riches.

Medical care

Medical care suppliers can use blockchain to safely store their patients' clinical records. At the point when a clinical record is produced and marked, it tends to be composed into the blockchain, which furnishes patients with the evidence and certainty that the record can't be changed. These individual wellbeing records could be encoded and put away on the blockchain with a private key, so they are just available by specific people, subsequently guaranteeing protection.

Records of Property

On the off chance that you have at any point invested energy in your nearby Recorder's Office, you will realize that the way toward recording property rights is both difficult and wasteful. Today, an actual deed should be conveyed to an administration worker at the neighborhood recording office, where it is physically gone into the region's focal information base and public file. On account of a property question, cases to the property should be accommodated with the public file.

This cycle isn't simply expensive and tedious—it is likewise loaded with a human blunder, where every error makes following property proprietorship less proficient. Blockchain can possibly wipe out the requirement for checking reports and finding actual documents in a nearby chronicle office. On the off chance that property possession is put away and checked on the blockchain, proprietors can believe that their deed is precise and for all time recorded.

In war-torn nations or zones that have practically no administration or monetary framework, and unquestionably no "Recorder's Office," it very well may be almost difficult to demonstrate responsibility for the property. On the off chance that a gathering of individuals living in such a region can use blockchain, straightforward and clear courses of events of property proprietorship could be set up.

Keen Contracts

A keen agreement is a PC code that can be incorporated into the blockchain to work with, confirm, or arrange an agreement understanding. Keen agreements work under a bunch of conditions that clients consent to. At the point when those conditions are met, the details of the understanding are consequently done.

Say, for instance, a potential occupant might want to rent a loft utilizing a keen agreement. The property manager consents to give the occupant the entryway code to the loft when the inhabitant pays the security store. Both the occupant and the landowner would send their individual segments of the arrangement to the shrewd agreement, which would clutch and naturally trade the entryway code for the security store on the date the rent starts.

If the landowner doesn't supply the entryway code by the rent date, the savvy contract discounts the security store. This would dispose of the charges and cycles commonly connected with the utilization of a legal official, outsider go-between, or attornies.

Supply Chains

As in the IBM Food Trust model, providers can utilize the blockchain to record the beginnings of materials that they have bought. This would permit organizations to check the validness of their items, alongside such normal marks as "Natural," "Neighborhood," and "Reasonable Trade."

Casting a ballot

As referenced, blockchain could be utilized to work with an advanced democratic framework. Casting a ballot with blockchain conveys the possibility to dispose of political decision extortion and lift elector turnout, as was tried in the November 2018 midterm races in West Virginia. Using blockchain in this way would make casts a ballot almost difficult to alter.

The blockchain convention would likewise keep up straightforwardness in the constituent cycle, diminishing the workforce expected to lead a political race and furnishing authorities with almost moment results. This would take out the requirement for describes or any genuine worry that misrepresentation may compromise the political race.

Benefits of Blockchain

Exactness of the Chain

Exchanges on the blockchain network are supported by an organization of thousands of PCs. This eliminates practically all human association in the confirmation cycle, bringing about less human blunder and an exact record of data. Regardless of whether a PC on the organization were to commit a computational error, the mistake would just be made to one duplicate of the blockchain.

All together for that mistake to spread to the remainder of the blockchain, it would be made by at any rate 51% of the organization's PCs—a close to difficulty for an enormous and developing organization the size of Bitcoin's.

Cost Reductions

Normally, shoppers pay a bank to confirm an exchange, a legal official to sign an archive, or a pastor to play out a marriage. Blockchain disposes of the requirement for outsider confirmation and, with it, their related expenses. Entrepreneurs cause a little expense at whatever point they acknowledge installments utilizing charge cards, for instance, since banks and installment preparing organizations need to deal with those exchanges. Bitcoin, then again, doesn't have a focal power and has restricted exchange charges.

Decentralization

Blockchain doesn't store any of its data in a focal area. All things being equal, the blockchain is replicated and spread across an organization of PCs. At whatever point another square is added to the blockchain, each PC on the organization refreshes its blockchain to mirror the change. By spreading that data across an organization, as opposed to putting away it in one focal data set, blockchain turns out to be harder to alter. On the off chance that a duplicate of the blockchain fell under the control of a programmer, just a solitary duplicate of the data, as opposed to the whole organization, would be undermined.

Effective Transactions

Exchanges set through a focal authority can take up to a couple of days to settle. If you endeavor to store a beware of Friday evening, for instance, you may not really see assets in your record until Monday morning. While monetary foundations work during business hours, five days per week, blockchain is working 24 hours every day, seven days per week, and 365 days per year.

Exchanges can be finished in just ten minutes and can be considered secure after only a couple hours. This is especially helpful for cross-line exchanges, which generally take any longer on account of time-region issues and the way that all gatherings should affirm installment preparing.

Private Transactions

Numerous blockchain networks work as open data sets, implying that anybody with a web association can see a rundown of the organization's exchange history. Even though clients can get insights regarding exchanges, they can't get to recognizing data about the clients making those exchanges. It is a typical misperception that blockchain networks like bitcoin are unknown when indeed they are just secret.

That is, the point at which a client discloses exchanges, their one-of-a-kind code called a public key, is recorded on the blockchain, instead of their own data. If an individual has made a Bitcoin buy on a trade that requires distinguishing proof then the individual's character is as yet connected to their blockchain address, yet an exchange, in any event, when attached to an individual's name, doesn't uncover any close to home data.

Secure Transactions

When an exchange is recorded, its validness should be confirmed by the blockchain network. A large number of PCs on the blockchain hurry to affirm that the subtleties of the buy are right. After a PC has approved the exchange, it is added to the blockchain block. Each square on the blockchain contains its own special hash, alongside the remarkable hash of the square before it.

At the point when the data on a square is altered in any capacity, that square's hashcode changes—in any case, the hash code on the square after it would not. This disparity makes it amazingly hard for data on the blockchain to be changed without notice.

Straightforwardness

Most blockchains are altogether open-source programming. This implies that anybody and everybody can see its code. This enables evaluators to audit cryptographic forms of money like Bitcoin for security. This additionally implies that there is no genuine expert on who controls Bitcoin's code or how it is altered. Along these lines, anybody can propose changes or moves up to the framework. On the off chance that a dominant part of the organization's clients concur that the new form of the code with the redesign is sound and advantageous then Bitcoin can be refreshed.

Banking the Unbanked

Maybe the most significant feature of blockchain and Bitcoin is the capacity for anybody, paying little mind to identity, sexual orientation, or social foundation, to utilize it. As per the world bank, there are almost 2 billion grown-ups that don't have financial balances or any methods for putting away their cash or wealth.5 Nearly these people live in non-industrial nations where the economy is at its outset and completely reliant upon cash.

These individuals frequently bring in little cash that is paid in actual money. They at that point need to store this actual money in secret areas in their homes or places of living leaving them subject to burglary or superfluous savagery. Keys to a bitcoin wallet can be put away on a piece of paper, a modest mobile phone, or even remembered whether vital. For a great many people, all things considered, these alternatives are more effectively covered up than a little heap of money under bedding.

Blockchains of things to come are additionally searching for answers for not exclusively be a unit of record for abundance stockpiling yet in addition to storing clinical records, property rights, and an assortment of other lawful agreements.

Burdens of Blockchain

While there are huge potential gains to the blockchain, there are additional critical difficulties to its selection. The detours to the use of blockchain innovation today are not simply specialized. The genuine difficulties are political and administrative, generally, to avoid anything related to a large number of hours (read: cash) of custom programming plan and back-end programming needed to incorporate blockchain to current business organizations. Here is a portion of the difficulties disrupting the general flow of inescapable blockchain appropriation.

Innovation Cost

Even though blockchain can get a good deal on exchange expenses, the innovation is a long way from free. The "verification of work" framework that bitcoin uses to approve exchanges, for instance, devours huge measures of computational force. In reality, the force from the large numbers of PCs on the bitcoin network is near what Denmark burns through every year. Accepting power expenses of $0.03~$0.05 each kilowatt-hour, mining costs selective of equipment costs are about $5,000~$7,000 per coin.10

Regardless of the expenses of mining bitcoin, clients keep on driving up their power bills to approve exchanges on the blockchain. That is because when diggers add a square to the bitcoin blockchain, they are compensated with enough bitcoin to make their time and energy beneficial. With regards to blockchains that don't utilize cryptographic money, nonetheless, excavators should be paid or in any case, boosted to approve exchanges.

A few answers for these issues are starting to emerge. For instance, bitcoin mining ranches have been set up to utilize sun-based force, abundance gaseous petrol from deep earth drilling destinations, or force from wind ranches.

Speed In-efficiency

Bitcoin is an ideal contextual investigation for the potential shortcomings of blockchain. Bitcoin's "confirmation of work" framework requires around ten minutes to add another square to the blockchain. At that rate, it's assessed that the blockchain organization can just oversee around seven exchanges each second (TPS). Albeit other digital forms of money, for example, Ethereum performs better compared to bitcoin, they are as yet restricted by blockchain. Heritage brand Visa, for setting, can measure 24,000 TPS.

Answers for this issue have been being developed for quite a long time. There are right now blockchains that are gloating more than 30,000 exchanges each second.

Criminal behavior

While classification on the blockchain network shields clients from hacks and jam security, it likewise takes into consideration unlawful exchanging and action on the blockchain network. The most referred to illustration of blockchain being utilized for unlawful exchanges is likely the Silk Road, an online "dull web" drug commercial center working from February 2011 until October 2013 when it was closed somewhere near the FBI.6

The site permitted clients to peruse the site without being followed by utilizing the Tor program and make illicit buys in Bitcoin or other digital currencies. Current U.S. guidelines require monetary specialist co-ops to acquire data about their clients when they open a record, check the personality of every client and affirm that clients don't show up on any rundown of known or suspected psychological militant associations.

This framework can be viewed as both a genius and a con. It gives anybody admittance to monetary records yet additionally permits hoodlums to all the more effectively execute. Many have contended that the great employments of crypto, such as banking the unbanked world, exceed the terrible employments of digital money, particularly when most criminal behavior is as yet achieved through untraceable money.

Guideline

Numerous in the crypto space have communicated worries about unofficial law over digital currencies. While it is getting progressively troublesome and close to difficult to end something like Bitcoin as its decentralized organization develops, governments could hypothetically make it unlawful to possess digital currencies or take an interest in their organizations.

Over the long run, this worry has developed more modestly as huge organizations like PayPal start to permit the possession and utilization of cryptographic forms of money on its foundation.

Future for BlockChain

First proposed as an exploration project in 1991,7 blockchain is easily subsiding into its late twenties. Like most recent college grads its age, blockchain has seen something reasonable of public investigation in the course of the most recent twenty years, with organizations all throughout the planet hypothesizing about what the innovation is prepared to do and where it's going in the years to come.

With numerous pragmatic applications for the innovation previously being carried out and investigated, blockchain is, at last, becoming well known at age 27, in no little part on account of bitcoin and digital money. As a trendy expression on the tongue of each financial backer in the country, blockchain stands to make business and government tasks more precise, productive, secure, and modest with fewer mediators.

As we plan to head into the third decade of blockchain, it's not, at this point an issue of "if" heritage organizations will get on to the innovation—it's an issue of "when."

0 Comments

Thanks for your feedback.